SCRA vs MLA: What Landlords, Lenders, and Businesses Need To Know

A single sentence can put a business at risk: “I’m in the military, so this doesn’t apply to me.”

For landlords, lenders, and companies handling credit or contracts, that claim often triggers confusion. Many assume there is one federal law that covers every military situation. In reality, two very different laws govern these scenarios, and applying the wrong one can expose you to serious legal consequences.

The Servicemembers Civil Relief Act focuses on civil and financial obligations that existed before a person entered active duty military service. The Military Lending Act governs certain consumer credit extended while a covered borrower is already on active duty status. They overlap in conversation but not in application.

Federal regulators and the Department of Justice have repeatedly enforced both laws against businesses that guessed instead of verifying, with outcomes that included refunds, penalties, and court action.

If you work with service members, understanding which law applies and when is not optional. The sections ahead break that line clearly.

Contents

- 1 Key Takeaways

- 2 What Is SCRA and What Does It Protect?

- 3 How SCRA Is Enforced and Why Verification Matters

- 4 What Is MLA and What Does It Protect?

- 5 SCRA vs MLA: Side-by-Side Comparison

- 6 How Businesses Should Handle SCRA and MLA Compliance In Practice

- 7 Real World Scenarios Where SCRA and MLA Often Get Confused

- 8 Turning Military Compliance Into a Repeatable Process

- 9 FAQs

Key Takeaways

- SCRA is a broad civil relief law that mainly protects pre-service obligations and civil proceedings during military service.

- MLA is a narrower lending rule that regulates certain high-cost consumer credit issued during active duty.

- SCRA focuses on leases, mortgages, repossessions, court judgments, and interest rate caps. MLA focuses on loan terms, pricing, and prohibited contract clauses.

- The two laws apply at different times and to different debts, so you cannot treat them as interchangeable.

- Verifying military status correctly is essential for SCRA compliance, while MLA requires separate checks for covered borrowers at the time of extending credit.

What Is SCRA and What Does It Protect?

Purpose and policy behind SCRA

The Servicemembers Civil Relief Act was created with a narrow but important goal: to reduce the civil and financial strain that military service can place on service members while they are fulfilling active duty obligations.

Lawmakers recognized that military service often removes a person from their normal ability to manage everyday responsibilities, even though those responsibilities continue to exist. SCRA is meant to prevent that disruption from turning into avoidable legal or financial harm.

That purpose explains what the law is, and what it is not. SCRA does not function as a debt forgiveness statute. It does not erase existing debts, cancel valid contracts, or eliminate financial obligations. Instead, the Civil Relief Act adjusts timing, limits enforcement, and reduces certain costs so obligations remain manageable during active duty military service rather than becoming punitive simply because the servicemember is unavailable.

Equally important is the type of matters SCRA addresses. The law operates entirely within the civil system. Its protections apply to civil obligations, civil court actions, and financial enforcement issues that military service can complicate.

Criminal proceedings are outside its scope, and SCRA was never intended to shield unlawful conduct or negate accountability under criminal law.

Who does SCRA cover?

SCRA applies based on current military status, not past service or intent to serve. The law is meant to protect people whose military duties limit their ability to manage civil and financial matters in real time.

At a basic level, SCRA covers:

- Active-duty personnel serving in the Army, Navy, Air Force, Marine Corps, and Coast Guard.

- Certain Reserve and National Guard members serving on qualifying federal orders.

- Commissioned officers of the National Oceanic and Atmospheric Administration and the Public Health Service who are on active status.

Coverage does not always stop with the servicemember. Some SCRA protections can extend to others who are directly tied to the same obligation. Depending on the situation, this may include:

- A spouse

- One or more dependents

- A co-obligor who signed the same contract or loan

That extension is not automatic. Whether a spouse, dependent, or co-obligor is protected depends on the specific SCRA provision being invoked and the servicemember’s active duty status at that moment. This is where many mistakes happen. Assuming everyone connected to a servicemember is covered can be just as incorrect as ignoring coverage that does apply.

For businesses, lenders, and landlords, SCRA coverage is a status-driven analysis, not a blanket rule. Eligibility must be evaluated carefully each time a protection is requested.

When SCRA Protections Apply?

SCRA is driven by timing. Whether a protection applies often depends on when the obligation was created and when the servicemember entered active duty. This is where many landlords, lenders, and businesses get it wrong.

Most financial protections under the Servicemembers Civil Relief Act apply to obligations that existed before the servicemember entered active duty military service. If a debt, credit account, or financial obligation was incurred before active duty, SCRA may limit how that obligation can be enforced once service begins.

Procedural protections follow a different timeline. Many of those protections apply while the servicemember is on active duty status, regardless of when the obligation originated. Some of these safeguards continue for a limited period after the individual leaves active service, recognizing that the transition back to civilian life does not happen overnight.

In practical terms, SCRA timing usually answers the threshold question:

- Was the obligation created before active duty, or after

- Is the servicemember currently on active duty, or recently released

If the timing does not line up, SCRA may not apply at all. That is why determining dates of military service and dates of obligation creation is often the first and most important step in any SCRA analysis.

Types of Obligations and Situations Covered by SCRA

SCRA applies to a defined set of civil obligations and enforcement situations that are most likely to be disrupted by active duty military service. The law does not cover every contract or dispute, but it does target areas where timing, presence, and income changes can create serious risk for service members and their households.

Common categories covered under the Servicemembers Civil Relief Act include:

- Interest rate reduction to six percent on eligible pre-service loans, credit card accounts, and other consumer credit extended before active duty

- Residential leases and certain vehicle leases when military orders require relocation or extended deployment

- Mortgage loans, foreclosures, and forced sales involving real property secured before military service

- Evictions from residential property when rent falls under the annually adjusted federal cap

- Vehicle repossession tied to pre-service installment loans or vehicle loans

- Enforcement of storage liens or repair liens on personal property

- Limited protections involving tax obligations and certain life or health insurance policies

What connects these situations is not the type of creditor or landlord involved, but the enforcement step. In many SCRA-covered scenarios, creditors, mortgage servicers, or property owners cannot act unilaterally. Court involvement is often required before moving forward with foreclosure, repossession, eviction, or sale.

This requirement exists to prevent default judgments or forced actions when a servicemember’s active duty status limits their ability to appear, respond, or negotiate. Ignoring that step is one of the most common and costly SCRA compliance failures for businesses.

How SCRA Is Enforced and Why Verification Matters

The Servicemembers Civil Relief Act is enforced actively, not symbolically.

Compliance failures involving active-duty military service regularly draw scrutiny from enforcement agencies, especially when financial institutions, mortgage servicers, or landlords take action without verifying active-duty status. SCRA enforcement does not rely on good intentions. It relies on whether the required steps were taken before acting on a financial obligation.

SCRA enforcement generally comes through:

- Civil actions brought by the Department of Justice

- Regulatory actions tied to federal law compliance

- Private lawsuits filed by service members seeking enforcement of SCRA protections

Penalties can escalate quickly. Courts have ordered damages, attorney fees, and refunds tied to improper enforcement of credit accounts, mortgage loans, and vehicle loans. In cases involving knowing violations of the civil relief act, consequences may extend further.

When creditors move forward despite clear indicators of military service, courts have the authority to impose serious civil penalties and, in limited circumstances, criminal consequences.

Courts often focus on process before substance. Judges frequently ask whether military status was verified before enforcement actions, such as:

- Vehicle repossession tied to pre-service installment loans or vehicle loans

- Eviction proceedings involving residential leases

- Default judgments related to consumer credit or other financial obligations

This expectation is not theoretical. Auto finance companies have entered high-profile settlements after repossessing vehicles from active duty servicemembers protected under SCRA. In many of those cases, the underlying debt was valid, but the enforcement failed because the creditor did not confirm active duty status before acting.

Military status verification is, therefore, central to SCRA compliance. Before enforcing credit extended, leases, or personal property interests, businesses are expected to confirm whether SCRA protections apply. That verification step often determines whether an action is lawful under federal law or exposes the business to avoidable risk.

What Is MLA and What Does It Protect?

Purpose and policy behind MLA

The Military Lending Act was created to address a specific problem: predatory lending practices aimed at servicemembers and their families at the moment they are most financially vulnerable.

Congress recognized that active duty status can make service members targets for high-cost credit products that rely on excessive fees, inflated interest rates, and aggressive repayment terms. MLA exists to stop that pattern before it starts.

Unlike the Servicemembers Civil Relief Act, the Military Lending Act does not operate as a broad civil relief law. It does not adjust court procedures, pause enforcement actions, or modify existing debts. Instead, MLA functions as a front-end rule that governs how certain consumer credit products may be offered to a covered borrower who is on active duty military service, including qualifying dependents.

The scope of MLA is intentionally narrow. It does not apply to every loan or credit account.

The law focuses on specific forms of consumer credit extended during active duty that historically carried the highest risk of abuse. These include products where pricing structures, participation fees, or bundled credit insurance could push the true cost of borrowing far beyond a reasonable annual percentage rate.

Who does MLA cover?

MLA coverage is based on a specific legal status at a specific moment. The law protects individuals who qualify as covered borrowers at the time consumer credit is extended. Unlike SCRA, coverage does not attach later, and it does not apply retroactively.

Under the Military Lending Act, covered borrowers include:

- Members currently serving in the Army, Navy, Air Force, Marine Corps, or Coast Guard

- Certain National Guard and Reserve members, when serving on qualifying active duty orders longer than 30 days

- Covered dependents, including qualifying spouses and children, as defined under federal law

The timing element is critical. MLA protections apply only if the borrower is on active duty military service when the credit transaction occurs.

If a personal loan, credit card account, or other consumer credit product is extended before active duty begins, MLA does not apply, even if the borrower later enters service. In such a situation, different rules may apply, but MLA protections would not be applicable.

This timing rule is where many compliance errors occur. Financial institutions sometimes assume that any servicemember automatically receives MLA protections, regardless of when credit is extended. That assumption is incorrect.

MLA coverage turns on active duty status at origination, not on military service at some later point. For lenders and businesses, confirming covered borrower status before extending credit is a foundational requirement under the lending act.

When MLA Protections Apply?

MLA applies at the moment new consumer credit is extended. If the borrower qualifies as a covered borrower and is on active duty military service at origination, the Military Lending Act governs the transaction. If that status is not present at the time credit is issued, MLA does not attach later, even if the borrower subsequently enters active duty.

This timing rule is deliberate. MLA is designed to regulate lending practices before harm occurs. It controls how covered consumer credit products are offered and priced during active duty, and protections apply automatically at origination without any action required from the servicemember.

This structure differs from SCRA. The Servicemembers Civil Relief Act is largely concerned with obligations that already exist before military service and how those obligations are enforced once active duty begins. MLA focuses on new credit extended during service, while SCRA modifies the enforcement of pre-service debt.

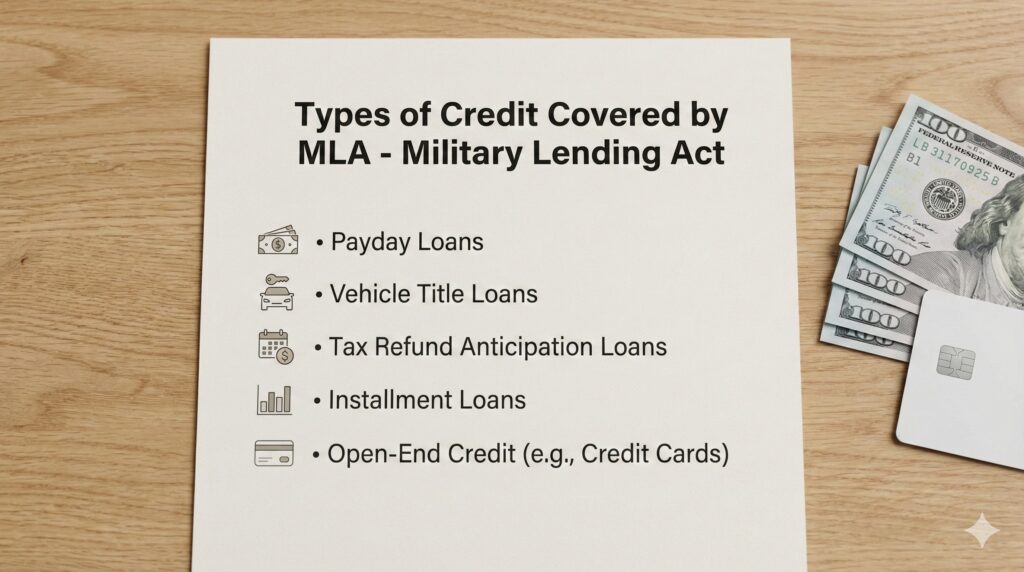

Types of Credit Covered by MLA

Not every loan offered to a servicemember falls under federal lending restrictions. Coverage depends on the structure and risk profile of the credit product itself, which is why some forms of consumer credit trigger special rules while others do not.

The Military Lending Act generally applies to consumer credit products that have historically carried higher costs or greater potential for abuse when extended during active duty. Covered categories commonly include:

- Many payday loans are built around short repayment terms

- Vehicle title loans that are not tied to purchasing the vehicle used as collateral

- Certain high-cost installment loans with elevated fees or pricing structures

- Some open-end credit products, including qualifying credit card accounts, when they meet the regulatory definition

At the same time, the law draws clear exclusions. Several common forms of credit are outside its scope, including:

- Most mortgage loans and home equity loans are secured by real property

- Traditional vehicle purchase loans, where the credit is used to buy the vehicle, and the loan is secured by that vehicle

Cost control is the defining feature of MLA coverage. Covered credit is subject to a 36% Military Annual Percentage Rate cap. This military annual percentage rate includes more than the stated interest rate. It also captures many additional charges, such as participation fees and certain credit insurance premiums, to prevent lenders from shifting costs outside the rate itself.

Key MLA Protections

MLA sets firm limits on how certain consumer credit can be offered to a covered borrower who is on active duty. These rules apply automatically when the credit is issued and do not depend on the servicemember asking for protection later.

The most visible protection is the cost cap:

- Covered credit cannot exceed a 36% Military Annual Percentage Rate. This military annual percentage rate (APR) includes the interest rate and various fees associated with the loan, such as participation fees and certain credit insurance premiums. Lenders cannot shift costs outside the rate to get around the cap.

MLA also controls what can appear in the loan agreement itself. Creditors are not allowed to use contract terms that limit a servicemember’s legal options or pressure them into unfair dispute processes. As a result:

- Mandatory arbitration clauses are prohibited on covered loans

- Waivers of certain federal and state rights, including some rights connected to military service, are not allowed

- Prepayment penalties cannot be charged

Disclosure is another core requirement. Before or at the time credit is extended, lenders must provide specific MLA disclosures in addition to standard lending disclosures. These disclosures must be in writing, and in some cases provided orally, so the borrower has a clear record of the cost and terms of the credit.

Taken together, these protections aim to prevent abusive lending terms from being incorporated into covered credit from the outset, rather than attempting to rectify the damage later.

How MLA Is Enforced and What Happens If Lenders Ignore It

MLA is enforced aggressively, and violations rarely stay small. When lenders extend covered consumer credit without following the military lending act, the consequences can reach far beyond a single loan.

Violations can lead to:

- Contracts are being declared void, meaning the lender may lose the right to collect on the debt

- Civil liability, including damages and repayment of fees charged to a covered borrower

- Administrative enforcement actions by regulators overseeing financial institutions

- Criminal penalties in situations involving knowing or repeated violations of federal law

Enforcement agencies focus heavily on process. Regulators do not look only at outcomes. They examine whether a lender had systems in place before extending credit.

In practice, lenders are expected to maintain clear procedures for:

- Identifying whether an applicant qualifies as a covered borrower based on active duty status

- Calculating the military annual percentage rate correctly for each credit transaction

- Ensuring prohibited clauses never appear in credit agreements

Understanding MAPR is central to compliance. The standard annual percentage rate typically reflects interest and a limited set of charges.

Military annual percentage rate is broader. MAPR includes the interest rate plus many additional costs tied to the credit, such as participation fees and certain credit insurance premiums. A loan with a low stated interest rate can still violate MLA if those added costs push the MAPR above 36 percent.

Regulators have made it clear that mere speculation is insufficient. Lenders that fail to verify covered borrower status, miscalculate MAPR, or rely on non-compliant contract templates face serious exposure under the lending act.

SCRA vs MLA: Side-by-Side Comparison

These two laws are often mentioned together, which is where confusion starts. SCRA and MLA protect servicemembers in very different ways, apply at different times, and regulate different types of obligations.

Seeing them side by side makes those distinctions clearer and helps prevent costly compliance mistakes.

| Dimension | SCRA Protections | MLA Protections |

|---|---|---|

| Core purpose | Civil relief to prevent military service from unfairly harming pre-service obligations and civil proceedings under the Civil Relief Act, scra. | Consumer credit rule designed to stop predatory lending practices aimed at active duty servicemembers and covered dependents. |

| Who is covered | Active duty members of the Army, Navy, Air Force, Marine Corps, and Coast Guard, certain National Guard and Reserve members on qualifying orders, and, in some cases, spouses, dependents, or co-obligors. | Covered borrowers, meaning an active duty servicemember or qualifying dependent at the time consumer credit is extended. |

| Timing | Primarily applies to obligations incurred before entry into military service and to civil proceedings during active duty, with limited post-service protections. | Applies only to new covered consumer credit issued while the borrower is on active duty status. |

| Types of obligations | Loans, leases, mortgage loans, installment contracts, evictions, foreclosures, liens, and some insurance or tax obligations. | Certain payday loans, vehicle title loans, high-cost installment loans, some open-end credit products, and credit card accounts are subject to exclusions. |

| Interest protections | Caps interest rate charges at six percent on eligible pre-service debts when properly invoked, including some fees. | Caps the military annual percentage rate at thirty-six percent on covered credit, including interest and many additional charges. |

| Court actions | Limits default judgments, allows stays of proceedings, and restricts enforcement actions such as eviction, foreclosure, and repossession without court involvement. | Does not focus on court procedure; instead restricts contract terms, pricing, and lending practices at origination. |

| Contract and lease relief | Allows termination of certain residential and vehicle leases without penalty when qualifying military orders are issued. | No general lease termination rights; the focus remains on consumer credit products. |

| Arbitration and waivers | Does not impose a blanket arbitration ban, though SCRA rights are protected and not easily waived. | Prohibits mandatory arbitration and certain waivers of federal and state consumer protection rights in covered loans. |

| Disclosures and documentation | Requires affidavits and written notices in court and enforcement contexts involving active duty service. | Requires specific written and, in some cases, oral disclosures in addition to standard Truth in Lending disclosures. |

Many landlords, lenders, and financial institutions must deal with both laws, sometimes involving the same servicemember at different points in time. The choice is not between SCRA or MLA.

Compliance often means knowing when one set of rules applies, when the other applies, and when both sets of rules must be respected in separate parts of the relationship.

How Businesses Should Handle SCRA and MLA Compliance In Practice

Step 1: Identify When SCRA Might Apply

SCRA issues usually surface at the moment a business is about to take action. Before moving forward, you need to pause and assess whether the situation falls into SCRA territory. This is not a legal formality. It is a risk checkpoint.

Start by asking two basic questions:

- Was this obligation created before the individual entered active duty military service

- Does the situation involve an enforcement step such as eviction, foreclosure, repossession, or a court judgment tied to a financial obligation

If the answer to either question is yes, SCRA should be treated as a serious compliance concern. The Servicemembers Civil Relief Act is designed to regulate how these actions unfold when active duty status limits a servicemember’s ability to respond or appear.

This is where many businesses make costly mistakes. Moving forward without recognizing SCRA exposure can invalidate an otherwise lawful action.

Whether the issue involves a residential lease, a mortgage loan, a vehicle loan, or another pre-service obligation, the timing of the debt and the nature of the enforcement step determine whether SCRA protections may apply.

Step 2: Verify Military Status Reliably for SCRA Purposes

Once SCRA risk is identified, verification becomes mandatory, not optional. Before a landlord files an eviction, a lender proceeds with repossession, or a business seeks a default judgment, courts often require a sworn affidavit stating whether the individual is on active duty in the military. Making that statement without reliable verification exposes the business to serious liability.

A verbal claim or informal documentation is not enough. A person stating they are in the military does not establish active duty status under federal law. Courts expect businesses to take reasonable steps to confirm whether SCRA protections apply before proceeding with any enforcement action tied to a financial obligation.

This is where SCRACVS plays a practical role in compliance. It allows businesses to:

- Confirm active duty status using official Department of Defense data

- Obtain written military status verification suitable for records and audits

- Request optional court-ready affidavits that align with SCRA requirements

- Reduce the risk of submitting incorrect or unsupported statements to a court

Reliable verification protects both sides. It ensures servicemembers receive the protections they are entitled to under the civil relief act, and it protects landlords, lenders, and financial institutions from enforcement actions based on assumptions or incomplete information.

For SCRA purposes, verification is not a courtesy. It is a compliance step that directly affects whether an eviction, repossession, or judgment can legally move forward.

Step 3: Identify When MLA Might Apply to Credit Products

MLA compliance comes into play at the front end of a credit transaction. Concerns should be triggered as soon as a lender or business prepares to offer or extend consumer credit. Unlike SCRA, which often appears at the enforcement stage, the Military Lending Act applies before the credit is finalized.

You should pause and assess MLA risk at two key moments:

- When offering or extending consumer credit that may fall within the definition of credit covered under the lending act

- When structuring the terms, fees, and pricing of that credit, including how the military annual percentage rate will be calculated

Because MLA protections depend on covered borrower status at the time credit is extended, lenders are expected to verify that status before closing the transaction. Regulators have been clear that this is not guesswork. Financial institutions are encouraged to rely on recognized safe harbor methods, such as the official Department of Defense MLA-covered borrower database or approved third-party verification tools.

Using these tools helps confirm whether the applicant qualifies as a covered borrower based on active duty status. It also provides documentation that the check was performed at the correct time. That record matters if a credit transaction is later reviewed by regulators or challenged by a servicemember.

Step 4: Build Separate Procedures for SCRA and MLA

SCRA and MLA solve different problems at different points in a business relationship. Treating them as one combined military check is a common mistake, and it is one that often leads to missed steps, incomplete documentation, or the wrong law being applied at the wrong time.

A cleaner approach is to separate your internal processes based on what you are doing, not who the customer is.

Most businesses benefit from maintaining two distinct checklists:

- An SCRA checklist used when enforcing existing obligations, such as evictions, repossessions, foreclosure activity, or court filings tied to pre-service debts

- An MLA checklist used when offering or extending new consumer credit products that may be credit covered under the military lending act

Keeping these procedures separate helps teams focus on the correct questions. SCRA analysis centers on the timing of the obligation, active duty status, and whether court involvement or written notice is required. MLA analysis focuses on covered borrower status at origination, product eligibility, contract terms, and military annual percentage rate calculations.

A short example shows why this separation matters. A lender issues a personal loan to a customer who is not on active duty at the time. MLA does not apply. Two years later, the same customer enters active duty military service and struggles to keep up with payments on that existing debt. At that point, SCRA may apply to how the lender enforces the obligation, even though MLA never applied to the original loan.

Real World Scenarios Where SCRA and MLA Often Get Confused

Understanding the difference between SCRA and MLA becomes easier when you see how they apply in everyday situations. The confusion usually comes from assuming that any issue involving a servicemember triggers the same law. These short scenarios show why timing and context matter.

Scenario 1: Auto Loan Entered Before Active Duty and Later Repossession

A servicemember takes out a vehicle loan, then later enters active duty military service. Months into service, the lender considers repossession due to missed payments.

This situation raises SCRA concerns. Because the loan was an existing debt created before active duty, the Servicemembers Civil Relief Act may limit how repossession can occur and whether court approval is required. The servicemember may also qualify for an interest rate reduction on the loan if proper written notice is provided.

MLA generally does not apply here. The credit transaction predates active duty, so it falls outside the scope of consumer credit extended during service.

Scenario 2: Payday Style Personal Loan Issued During Active Duty

A lender offers a short-term personal loan to a borrower who is already on active duty status. The loan includes high fees and a rapid repayment schedule.

This scenario often triggers MLA. The Military Lending Act may cap the military annual percentage rate at thirty-six percent, restrict contract terms, and require specific written and sometimes oral disclosures. These protections apply automatically at origination because the borrower qualifies as a covered borrower.

If the loan later goes into default and the lender seeks a judgment or enforcement action, SCRA may also come into play at that later stage.

Scenario 3: Residential Lease Signed Before Active Duty and Later Eviction

A tenant signs a residential lease, then enters active duty and later falls behind on rent. The landlord moves toward eviction.

Here, SCRA is the controlling law. The Civil Relief Act may require court involvement before eviction, allow stays of proceedings, and require the court to consider whether military service materially affects the tenant’s ability to pay. These protections focus on the enforcement process.

MLA does not govern the lease itself, since it applies to consumer credit products rather than tenancy or housing obligations.

These examples show why SCRA and MLA cannot be treated as interchangeable. Each law applies to different obligations, at different times, and for different reasons.

Turning Military Compliance Into a Repeatable Process

SCRA and MLA are closely related, but they solve different problems. SCRA governs civil relief tied to obligations and court actions that military service can disrupt. MLA regulates high-cost consumer credit issued during active duty. Confusing the two often leads to the wrong decision at the wrong time.

That confusion creates real consequences. Landlords may take enforcement steps that require court approval. Lenders may overlook required protections or assume limits apply when they do not. These mistakes expose businesses to legal challenges, refunds, chargebacks, and enforcement action, while servicemembers may lose protections the law clearly provides.

The better approach is to treat military compliance as an ongoing process, not a one-off check. Any landlord, lender, law firm, or business working with military tenants or borrowers should build military status verification into standard workflows before filing court papers, evicting, repossessing, or enforcing judgments.

SCRACVS supports that process by helping you confirm active duty status, obtain documentation that demonstrates SCRA due diligence, and reduce the risk of wrongful actions against protected servicemembers.

To handle military verification in a consistent and defensible way, you can learn more or open an account at SCRACVs.

FAQs

Do SCRA or MLA apply to unpaid rent and evictions?

Unpaid rent and evictions are governed primarily by the Servicemembers Civil Relief Act, not the Military Lending Act. SCRA protections can apply when a residential lease was signed before active duty military service, and the servicemember’s ability to pay is materially affected by active duty orders. In those situations, federal law may require court involvement before eviction and limit enforcement actions. MLA does not apply to lease obligations because it focuses on consumer credit products, not tenancy or housing matters.

Does MLA apply to mortgages or vehicle purchase loans?

The Military Lending Act generally does not apply to most mortgage loans or traditional vehicle purchase loans. Mortgages secured by real property, including home equity loans, are excluded from MLA coverage. Vehicle loans used to purchase the vehicle securing the loan are also excluded. MLA targets specific high-cost consumer credit products, including payday loans, vehicle title loans, and certain types of installment loans. Even when MLA does not apply, other federal laws or SCRA protections may still affect enforcement.

Do I need to check military status before filing an eviction or repossession?

Yes. Courts often expect landlords and creditors to verify active duty status before filing an eviction, repossession, or seeking a default judgment. Under the Servicemembers Civil Relief Act, failing to confirm military service can invalidate enforcement actions and expose businesses to liability. A person’s claim of military service is not enough. Reliable verification using Department of Defense data helps ensure compliance and supports required affidavits tied to SCRA protections and court procedures.

Can a servicemember waive their SCRA or MLA rights?

SCRA and MLA rights cannot be waived casually. SCRA protections are tied to federal law and often require specific conditions or court oversight before any waiver is considered valid. MLA goes further by prohibiting certain waivers outright, including mandatory arbitration clauses and some waivers of federal or state consumer protection rights in covered credit agreements. Contract language attempting to bypass these protections is often unenforceable and can create serious compliance risk for lenders.

Do MLA protections cover business loans?

MLA protections do not cover most business loans. The Military Lending Act applies to consumer credit extended to a covered borrower for personal, family, or household purposes. Credit extended for business or commercial use generally falls outside MLA coverage. However, lenders must still evaluate how credit is structured and documented, since misclassification of a credit transaction can lead to errors in determining whether MLA or other federal protections apply.